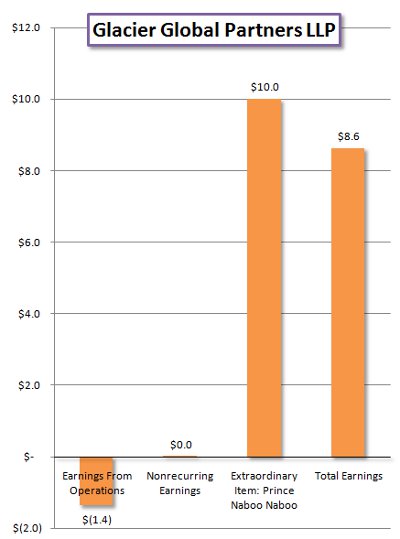

WHITE PLAINS, NEW YORK — Glacier Global Partners LLP will report positive quarterly earnings for the first time since its inception, co-founder Yaniv Blumenfeld announced.

Earnings from continuing operations continues to trend downward, although Glacier Global reported several new sources of continuing revenue: collections from unauthorized pay toilet meters installed in common area rest rooms in the Manhattan building where Glacier Global leases 600 square feet, sales of toilet paper requisitioned from said rest rooms, sales of second-hand mops and buckets cadged from the building’s janitor closets, protection revenue from other tenants in the building, rental of the office as a homeless shelter during off hours, miscellaneous blackmail receipts and revenue from the promising fake electronic tax return filing segment.

Nonrecurring revenue included payments by former unpaid interns to settle non-compete lawsuits and settlements arising from frivolous personal injury claims against the firm’s previous landlord at 1166 Avenue of the Americas.

A single extraordinary revenue item brought Glacier Global’s quarterly bottom line solidly into the black. Glacier Global recognized a portion of a $20 million receivable attributed to an advance fee arrangement with a member of the Nigerian Royal Family. The firm has satisfied its obligations under the agreement with Nigerian Crown Prince Naboo Naboo and Blumenfeld said he expects the receivable to be liquidated in the third quarter. “Nigeria has a BB- (stable outlook) rating from both S&P and Fitch, so this is pretty much a no-brainer,” according to Blumenfeld. Glacier Global used a forward currency swap to hedge against currency fluctuations on the euro-denominated unsecured promissory note. There was no comment from Prince Naboo Naboo, who went radio silent at approximately the moment Glacier Global’s wire transfer went through, about three weeks ago.

Blumenfeld said the outlook for coming quarter is even better. The firm expects to recognize a gain in connection with the anticipated expungment of the lingering Five Franklin Place Fatwa, issued by a Shia Mufti in 2007 against the firm’s proposed TriBeCa condo development. The Five Franklin Place Fatwa is an absolute Islamic death sentence or Haraam deduced from Qur’anic verses and ahadith and imposed upon anyone connected with the property, including owners, tradesmen, financiers and occupants. Until now, the fatwa’s stigma led potential lenders and condo buyers to shun Five Franklin Place. Now Glacier Global has engaged a Talmudic neo-Tanna to expunge the fatwa and drape a veil of spiritual protection around the property through esoteric mysticism. The resulting immediate cessation of mysterious acts of sabotage that have plagued the Five Franklin Place development, along with the stigma’s erasure, will substantially boost the property’s value according to a draft appraisal.

A capital investment involving magic beans is also expected to begin cash flowing almost immediately, Blumenfeld said.

I don’t concur with this amazing submit. Even now, I saw it considered around Aol and I’ve realized you are appropriate and i also ended up imagining during the incorrect process. Go on writing the best quality materials along these lines.