Nigerian-flagged SS Yaniv Blumenfeld wallows in Long Island Sound with a full cargo of Scheiße Buchstaben.

By Two-Gun Crowley

Special to helgabluth

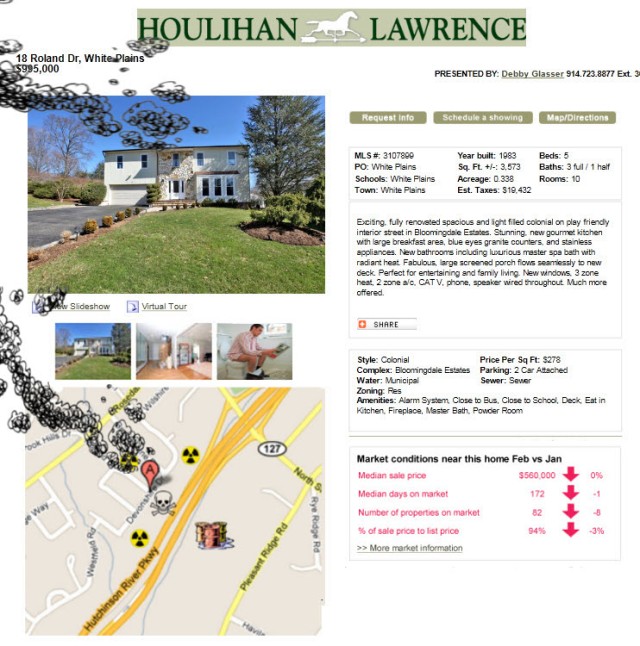

WHITE PLAINS, NY – April 4, 2011 – Jones Lang LaSalle (JLL) announced today that it rescued Wall Street drowning rat Kellogg Gaines from the sinking ship of White Plains, NY-based Glacier Global Partners, LLP. Once the soaking-wet Gaines dries out, he will be tasked with trying to get various financial institutions to invest in his specialty, bad loans, while hoping to hang on at JLL long enough until the stigma of Glacier Global Partners wears off. But given current financial markets, Gaines is unlikely to meet with success except with the most gullible lenders. “If he’s lucky, he might dump a few turds on New York Life,” according to an investigator in the New York attorney general’s office.

Gaines will bear essentially meaningless title of “Managing Director”, laboring on commission until the office market comes back, at which time JLL will either lease the space to a real tenant or give Gaines’ desk to someone else more productive, probably an office leasing broker. (Editor’s note: “Managing Director” is the new “Vice President”.)

The Good Years: Gaines Closes $12 Million CMBS Loan

“We had a desk to fill and we filled it. Attracting a survivor like Kelly, who has 20 years of turd mining experience with 15 of those in the muddy trenches of third- and fourth-tier Wall Street firms and first-tier bucket shops is proof that we are committed to staying in business for at least another year,” said Jay Koster. “With all that experience, it’s hard to believe the guy’s never served any time.”

Tom Fish added, “Kelly is notorious among CMBS (Scheiße Buchstaben) special servicers,” who honored him with the punny moniker ‘Large Loss’ Gaines. “He’s left a Shermanesque trail in throughout every major market in the United States. He’ll definitely synergize backward overflow for our clients.” For his part, ‘Large Loss’ Gaines loves the nickname and trades on it. “They’re calling me Large!”

Depending on who wants to know, Gaines claims two decades of diversified real estate ‘experience’ obtained by officing in roughly the same building where about $8 billion of commercial real estate ‘loans’ were being “worked on by someone”. Whatever Gaines’ actual role, it is unlikely he was a ‘major mover’ in bringing about the nation’s most recent financial meltdown as he claims.

Glacier Global Brown Out. "Why is it so dark?"

A well-placed source acknowledged that Gaines’ abandoned role as a Partner of Glacier Global Partners, LLC, was basically a fake position intended to fill a gap on his resume during the financial depression until a real job appeared. Gaines realized it was time to move on—to anywhere else, really—once the malignant Glacier Global started to look like a liability. At least that’s the story that minimizes his potential culpability. Previously he also showed up for work at several other discredited financial firms where he was responsible (but not to blame) for suborning their credit and compliance departments and ginning up the cosmetic underwriting paperwork necessary to stick unsophisticated, vulnerable institutional CMBS bond buyers with low-quality loans secured by the nation’s least-desirable real estate. Or, in Wall Street jargon, “originating commercial real estate loans for securitization, flatulization, syndication and on-book executions.”

Yaniv Blumenfeld

Notwithstanding the the loss of his partner-level ColecoVision gaming privileges at Glacier Global, Gaines allowed that his new office space at JLL was “way better” than the cubbyhole he occupied in the sooty White Plains home basement belonging to Yaniv Blumenfeld, Glacier Global’s head turd miner. “There’s also a lot less screaming going on in the background” at JLL, Gaines said.